👋 Hey there! I'm TJ. I write about data products, technology, software, and economics.

I'm a husband and father, living in Singapore, and from the Philippines. I explore data engineering and accounting at Titanium Birch.

On Pump Prices: Where can you gas up for less?

BLACK GOLD - In a time of risi’ng oil prices, it might pay off to be a little more data-savvy about where you gas up. (Photo: Patricia Feaster/Flickr, CC BY 2.0)

What providers let your stretch you gas money for more miles? Where is it more economical to gas up? Data from the Department of Energy’s price watch can provide some data-driven answers to these questions.

Everyone has something to say about gas prices - it’s cheaper to gas up with this provider than another, or it’s more economical to fill the tank in this area than another. With data from the Department of Energy’s price watch, we can provide data-driven answers to these questions, so that you can stretch out your gas money for just a few more kilometers.

On the Economics and Data of Love, Dating, and Relationships

Last Valentine’s Day, I was asked by my former college organization to deliver a talk on the “data of love, dating, and relationships” as part of their Young Economists' Lecture and Learning Series at De La Salle University.

I thought I’d share the presentation with you and put this up for posterity’s sake. Hopefully, you can piece together what I was talking about.

I’d appreciate it if you liked, tweeted, shared, or +1’ed this post on your preferred social network, as well as shared your thoughts in the comments section.

On Taxes: Do Filipinos really pay the highest taxes among ASEAN countries

LABORIOUS LEVIES - This ad in a newspaper cites the claim of the Tax Management Association of the Philippines, taken from the Instagram account of Senator Sonny Angara, one of the main advocates for reducing income tax rates.

The Tax Management Association of the Philippines (TMAP) claims that Filipinos pay the highest tax rates among countries in the Association of Southeast Asian Nations (ASEAN). This is their basis for arguing in favor of lower income taxes and inflation-sensitive tax brackets.. While the debate on whether lower taxes can be an overall sound policy rages on, let’s focus on this particular claim and determine whether Filipinos really do pay the highest taxes in the region.

On Presidential Priorities (July 2014): Aquino moves toward legacy

Aquino’s 5th SONA word counts suggest a shift of focus from current national issues toward long-term legacies such as education, budget management, and poverty alleviation. However, the overall message echoed by the administration remains the same. (Photo: Official Gazette, public domain)

I previously wrote a post that tries to get a feel of the priorities of each administration at various points in time, by measuring how many times each speech mentions certain words that relate to national issues. Following the recent 2014 SONA of President Aquino, we update the data to see what’s changed, and whether there are any shifts in the priorities of his administration.

Please feel free to read the [[On Presidents and Priorities|original post]] to view how this data was collected, shaped, and presented.

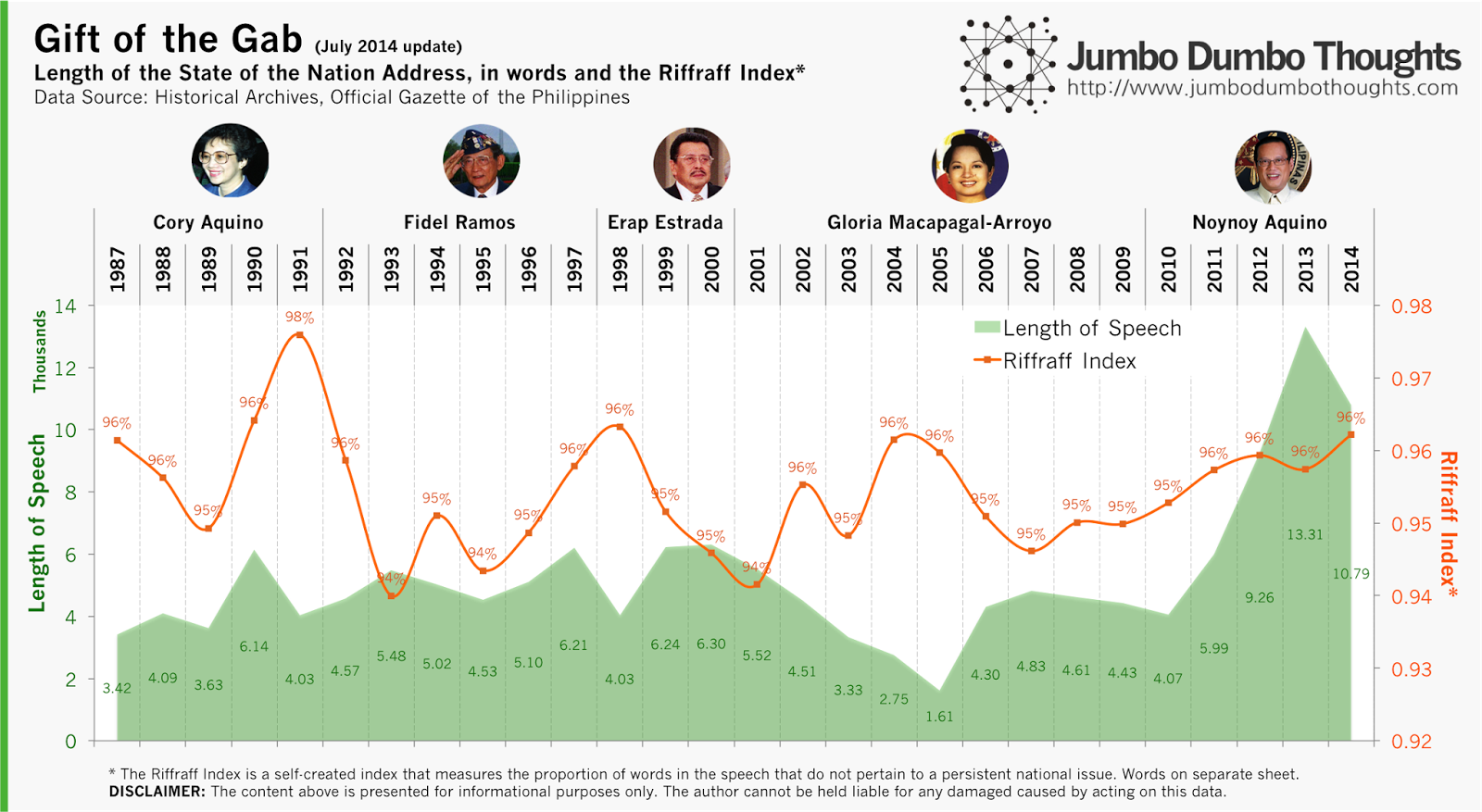

The Basics: Length of speech and the Riffraff index

Let’s take a look at the overall length, and how much of the speech actually contained meaningful content, as measured by the Riffraff Index.

President Aquino’s 5th SONA is shorter than last year’s, but still quite long at around ten thousand words, making it the second longest SONA since his mother’s time. Despite this cutting down of length, the amount of riffraff increased, probably due to his lengthy discussion of various calamities and also the legacy statement near the end of the speech.

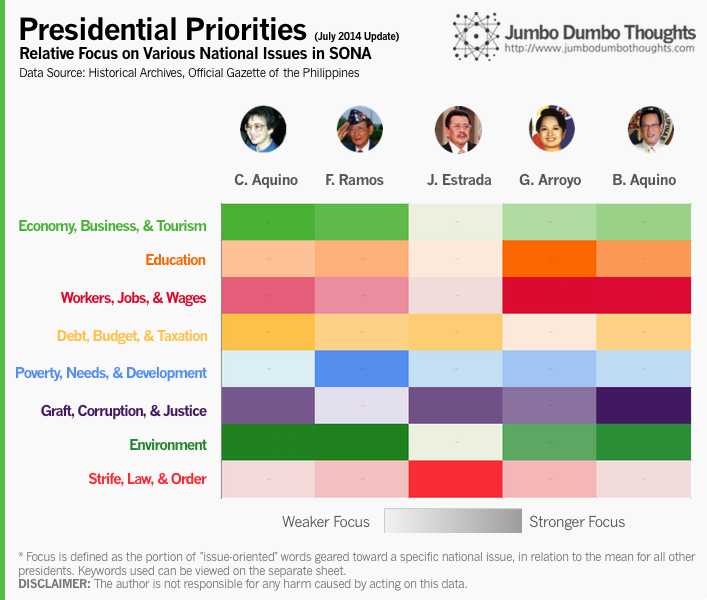

Presidential Priorities 2014: Education, government finance, and poverty

Let’s use the same criteria to determine the trends in the priorities of various administrations. Will it have changed for President Aquino? Let’s find out:

The President focused more on education (TESDA), poverty (poverty rate and conditional cash transfers), and government finance (debt management, investment rating upgrade) compared to previous speeches. There was less focus on environment and law and order compared to previous speeches. As the term ends, the administration might be focusing more on long-term legacies such as education and balancing government books rather than current issues such as corruption, law and order, economy, and employment.

Priority Heatmap: No change in overall priorities

How does the new data affect the overall priorities of the Aquino administration? The answer is: not much.

Overall, compared to other administrations, the Aquino administration is still very much focused on both graft, corruption, justice and workers, jobs, wages, with a slight shift towards education.

Interactive Word Counter

You don’t have to take my word for it; the word count data is available for you to explore and draw insights from. Just input the words you’d like to count in the five white boxes (use space to clear out a cell), and see it reflected in the graph.

Unfortunately, this link has expired and I don’t have time to recover it.

Hope you enjoy discovering new trends with the tool! If you find an interesting pattern, please don’t hesitate to share it in the comments!

Thanks for reading! If you enjoyed reading, I’d appreciate it if you shared this with your friends or comment below. Data and computation inquiries can be made through the contact form or the comments.

aliases: - 2014/08/sona-words-july-2014.html - content/blog/2014-08-13-sona-words-july-2014/sona-words-july-2014.html - posts/2014-08-13-sona-words-july-2014 - articles/sona-words-july-2014

On Pork and Plunder: The numbers behind the Priority Development Assistance Fund (PDAF) scam

For the first time in Philippine history, three Senators have been arrested without bail on charges of plunder. In this photo are the three Senators in question after Sen. Revilla delivered his privilege speech last June 2014.(Photo: Alex Nuevaespaña/Senate PRIB)

On charges of plunder related to the PDAF or pork barrel scam, three senators - Enrile, Estrada, and Revilla - were arrested in separate occasions during the past week, joining the alleged pork barrel mastermind Janet Lim-Napoles in incarceration. The trial will surely play out in a methodical, if not slow, pace, and many Filipinos will be in want of the case’s speedy resolution. What we can do right now, is to take PDAF releases data from the Department of Budget and Management and use it to take a look at the numbers behind the PDAF scam - how much did they release, to whom, and for what? These are questions we can answer with the data.

On Latin Honors: How hard is it to get to the top?

NOT LIKE THE OLD DAYS - Latin honors may not be as exclusive an award as it was before. (Photo: gadgetdude/Flickr, CC BY 2.0)

I was reading this article on how Latin honors have become increasingly common among graduates in recent history, and it contained interesting comparative data on various universities in Manila.

On the Overweight and Obese: 1 in 4 Filipino adults are overweight, 1 in 20 are obese

From roughly 16%, 25% of the Filipino population is now overweight. (Photo: Thomas Kohler/Flickr, CC BY-SA 2.0)

A report by the Institute for Health Metrics and Evaluation reveals that obesity for both children and adults is on the rise in the Philippines. While girls are less prone to obesity than boys early on, this trend reverses as they become adults. However, both sexes are still losers in the battle of the bulge, as obesity rates increase as they age.

Filipinos love to eat, and the latest report from the Institute for Health Metrics and Evaluation (IHME) show that it might be negatively impacting obesity and overweight rates.

First, let’s take a look at obesity and overweight rates for both children and adults over time:

From 16% (1 in 6) in 1980, Roughly 25% (1 in 4) Filipino adults are overweight. The obesity rate has also increased from 3% to 5% in the past 30 years. For children, the overweight rate has nearly doubled from 2.7% (1 in 40) to 5.5% (1 in 20). Obesity rates have also been on the rise.

Next, let’s divide up the population by gender to see the differences between males and females:

There is a peculiar trend going on between the sexes. Overweight and obesity rates for female adults are higher than for male adults, but the opposite is true for children. Is this the effect of pregnancy in adulthood?

Lastly, we cut the population into age groups, and see how that’s evolved over time:

Obesity and overweight rates peak in around your 50’s, and are lowest in the late teens. Funnily enough, this seems to correlate with income over a person’s lifetime. The wallet grows and shrinks with the belly, doesn’t it?

There you go: a quick data primer on Filipino obesity and overweight rates. I think I’ll have to take a rain check on that buffet dinner.

Thanks for reading! If you found this post interesting, I’d appreciate it if you shared it on your social networks, or shared your thoughts in the comments. Data can be gathered from the IHME website.