Information and links may be outdated.

How the 2008 Financial Crisis Still Affects Us

I had recently stumbled upon this video that stitches together the great recession of 2008 to the crisis we are experiencing now. It’s a great video, and I recommend watching it in its entirety.

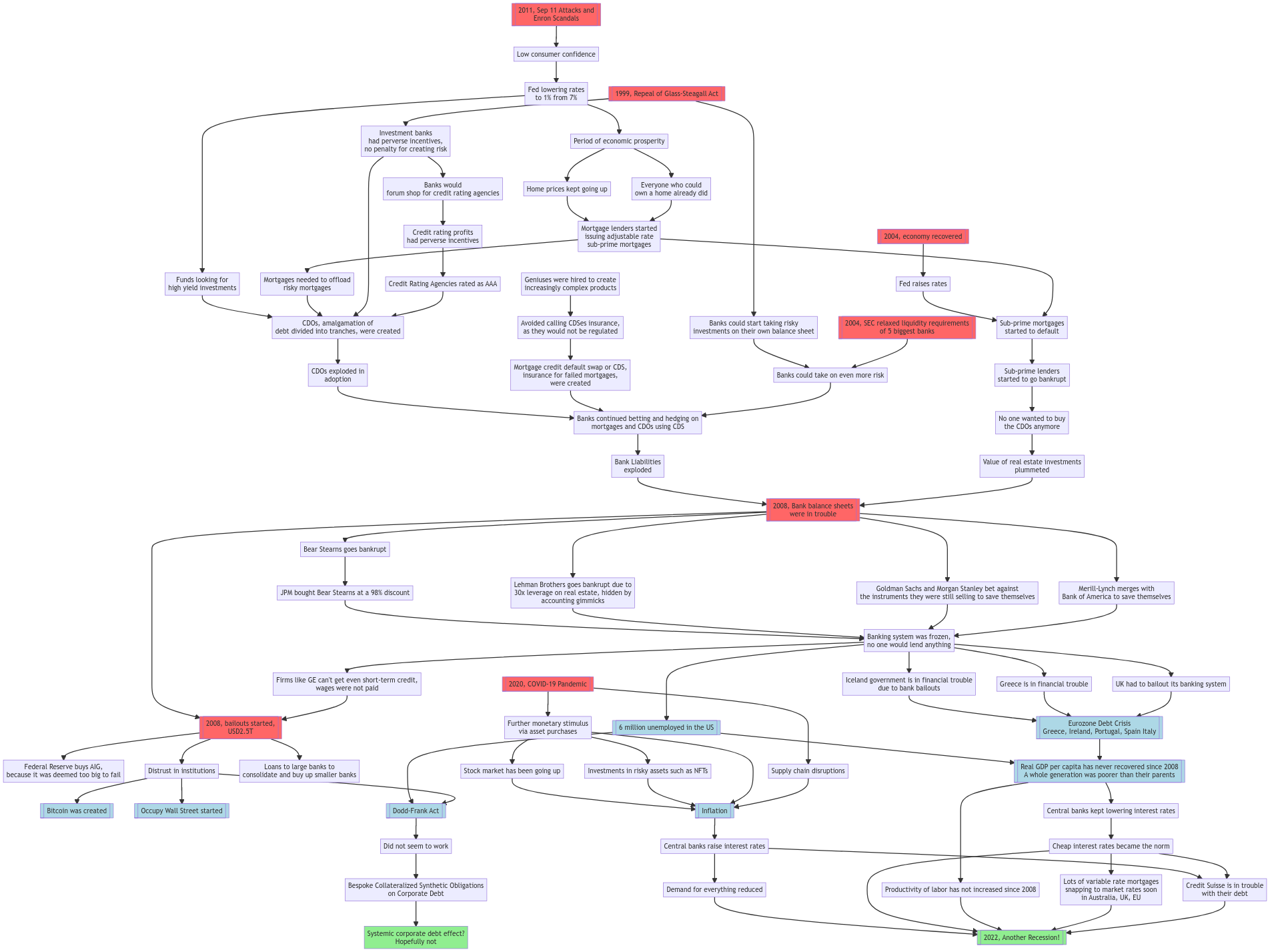

One thing I found super fun to build was a map of the root causes and effects stemming from 20 years ago all the way to today, and I wanted to share it here in case it helps anyone make sense of the mess.

flowchart TD

classDef root fill:#f66;

classDef effect fill:lightblue;

classDef speculation fill:lightgreen,stroke:dash;

PEP --> HPK

GSA[[1999, Repeal of Glass-Steagall Act]]:::root --> BRI[Banks could start taking risky\ninvestments on their own balance sheet]

GSA --> IBI

S11[[2001, Sep 11 Attacks and\nEnron Scandals]]:::root --> LCC[Low consumer confidence] --> FLR[Fed lowering rates\nto 1% from 7%] --> PEP

PEP[Period of economic prosperity] --> HON[Everyone who could\nown a home already did]

HPK[Home prices kept going up] --> SPM

HON --> SPM[Mortgage lenders started\nissuing adjustable rate\nsub-prime mortgages]

SPM --> ORM[Mortgages needed to offload\nrisky mortgages]

FLR --> FLY[Funds looking for\nhigh yield investments]

FLY --> CDO[CDOs, amalgamation of\n debt divided into tranches, were created]

ORM --> CDO

CRP[Credit rating profits\nhad perverse incentives] --> CRA

IBI[Investment banks\nhad perverse incentives,\n no penalty for creating risk] --> CDO

IBI --> FOR[Banks would\nforum shop for credit rating agencies] --> CRP

CRA[Credit Rating Agencies rated as AAA] --> CDO

FGE --> AVO[Avoided calling CDSes insurance,\nas they would not be regulated] --> CDS

FGE[Geniuses were hired to create\nincreasingly complex products]

CDS[Mortgage credit default swap or CDS,\ninsurance for failed mortgages,\nwere created]

CDO --> CDI[CDOs exploded in\nadoption]

CDI --> BCDS[Banks continued betting and hedging on\nmortgages and CDOs using CDS]

CDS --> BCDS

BRI --> BLA[Banks could take on even more risk] --> BCDS

SEC[[2004, SEC relaxed liquidity requirements\nof 5 biggest banks]]:::root --> BLA

BCDS --> BLI[Bank Liabilities\nexploded]

ERE[[2004, economy recovered]]:::root --> FRR[Fed raises rates]

FRR --> SPU[Sub-prime mortgages\nstarted to default]

SPM --> SPU

SPU --> SPL[Sub-prime lenders\nstarted to go bankrupt]

BLI --> BBS[[2008, Bank balance sheets\nwere in trouble]]:::root

SPL --> CDD[No one wanted to buy\nthe CDOs anymore] --> VM[Value of real estate investments\nplummeted] --> BBS

BBS --> BSD[Bear Stearns goes bankrupt] --> JPM[JPM bought Bear Stearns at a 98% discount] --> BSF

BBS --> LBD[Lehman Brothers goes bankrupt due to\n 30x leverage on real estate, hidden by\n accounting gimmicks] --> BSF

BBS --> GSM[Goldman Sachs and Morgan Stanley bet against\nthe instruments they were still selling to save themselves] --> BSF

BBS --> ML[Merill-Lynch merges with\nBank of America to save themselves] --> BSF

BSF[Banking system was frozen,\n no one would lend anything] --> FL[Firms like GE can't get even short-term credit,\n wages were not paid]

BBS --> BOS[[2008, bailouts started,\nUSD2.5T]]:::root --> AIG[Federal Reserve buys AIG,\n because it was deemed too big to fail]

FL --> BOS --> DTI[Distrust in institutions] --> BTC[[Bitcoin was created]]:::effect

DTI --> OWS[[Occupy Wall Street started]]:::effect

BOS --> LTB[Loans to large banks to\nconsolidate and buy up smaller banks]

BSF --> ICE[Iceland government is in financial trouble\ndue to bank bailouts] --> EUR

BSF --> GRC[Greece is in financial trouble] --> EUR

BSF --> UK[UK had to bailout its banking system] --> EUR

EUR[[Eurozone Debt Crisis\nGreece, Ireland, Portugal, Spain Italy]]:::effect

BSF --> UN[[6 million unemployed in the US]]:::effect --> DFA

DTI --> DFA[[Dodd-Frank Act]]:::effect --> DS[Did not seem to work] --> BCSO

BCSO[Bespoke Collateralized Synthetic Obligations\non Corporate Debt] --> CS[Systemic corporate debt effect?\n Hopefully not]:::speculation

UN --> REAL[[Real GDP per capita has never recovered since 2008\nA whole generation was poorer than their parents]]:::effect

EUR --> REAL --> CBR[Central banks kept lowering interest rates]

CBR --> INT[Cheap interest rates became the norm]

REAL --> PROD[Productivity of labor has not increased since 2008]

COVID[[2020, COVID-19 Pandemic]]:::root --> MP[Further monetary stimulus\nvia asset purchases]

MP --> SM[Stock market has been going up] --> INF

MP --> NFT[Investments in risky assets such as NFTs] --> INF

COVID --> PRD[Supply chain disruptions]

MP --> INF[[Inflation]]:::effect

PRD --> INF

INF --> CBR2[Central banks raise interest rates]

CBR2 --> DMD[Demand for everything reduced]

DMD --> REC[[2022, Another Recession!]]:::speculation

INT --> REC

PROD --> REC

INT --> VRM[Lots of variable rate mortgages\nsnapping to market rates soon\nin Australia, UK, EU] --> REC

CBR2 --> BNK

INT --> BNK[Credit Suisse is in trouble\nwith their debt] --> REC

Here's an image version.

Here’s the original video embedded in case you want to watch the whole video:

content/thoughts/2022-11-08-financial-crisis/2022-11-08-financial-crisis.html thoughts/financial-crisis-still-affects-us

Subscribe to get updates:

Your email won't be shared with third-parties and will only be used for sending you the newsletter.