Thoughts

Thoughts are evolving thoughts or opinions, and may or may not be fully accruate. The intention is to checkpoint how I think about a particular idea over time an share my viewpoints.

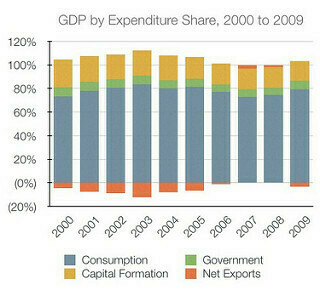

- Consumption makes up a very large chunk of our GDP, and while this may mean we’re happier, it means we have less to save and use for weathering shocks and building up productive capital. The ADB reports that household saving went from 9.8% of GDP in 2000 to 2.4% of GDP in 2007. Likewise, the BSP conducted a survey to find out that 8 out of 10 Filipinos were unbanked.

- Filipinos love the lottery, especially the poor and uneducated. The odds are horrible and you only win what’s left after the many tax and charitable deductions. It’s called a fool’s game or even a “tax on stupid people” for a reason.

On Economics Education

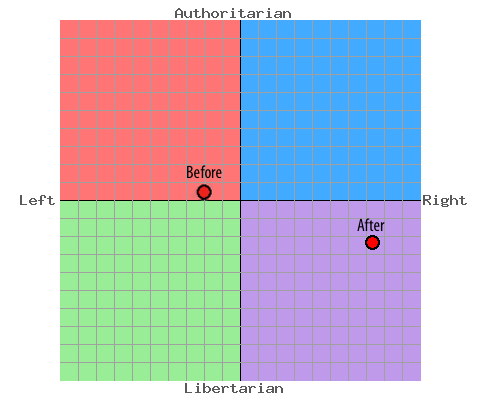

Here’s what four years of economics education has done to my political leanings. I figure this isn’t rare.

My Political Compass Change

thoughts/on-economics-education

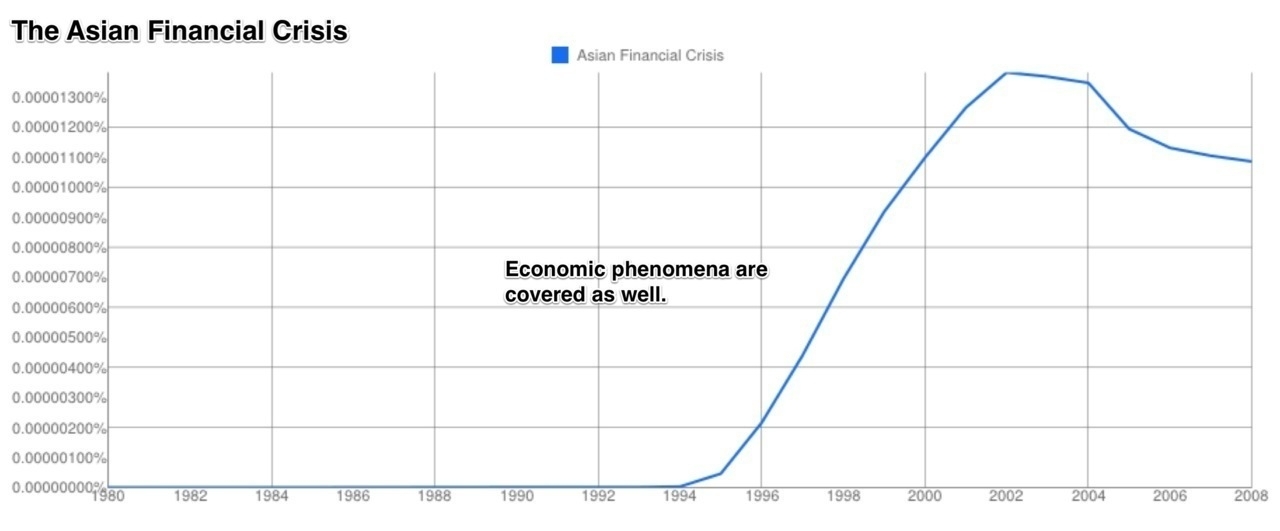

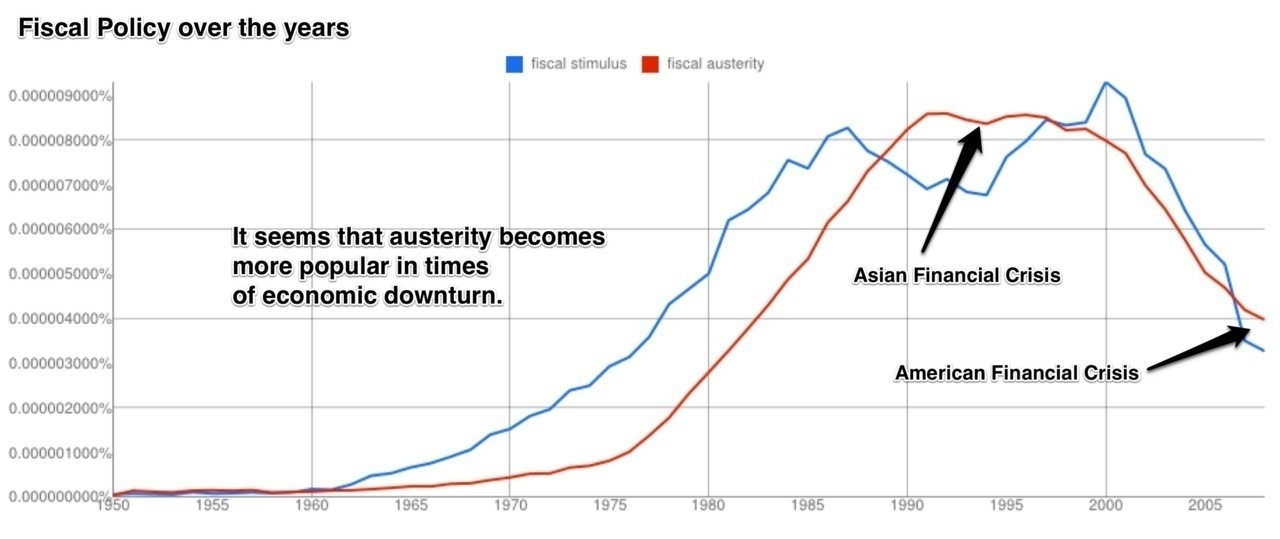

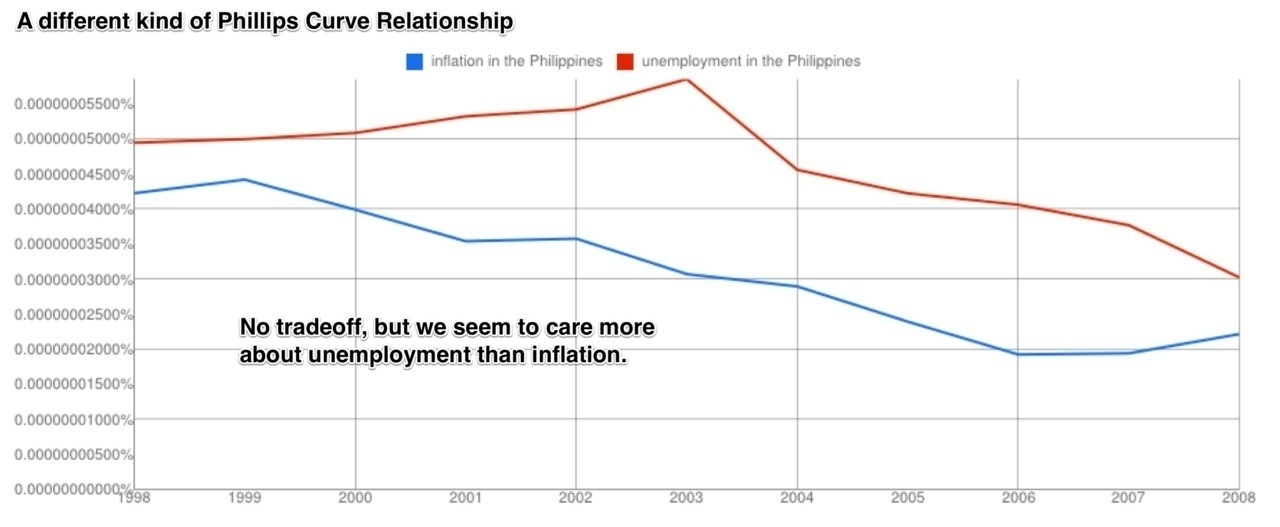

On Ngrams Part 2: The Philippine Economy

Here’s the second part of this series on ngrams, as I’ve mentioned in a previous blog post. I’ve been messing around with the Google Ngram Viewer which was highlighted in a previous post. If you don’t already know, ngrams are basically charts that display how often a word or phrase appears in Google’s entire book collection. It’s a rough but quick and easy way to find out what people were writing about in various time periods.

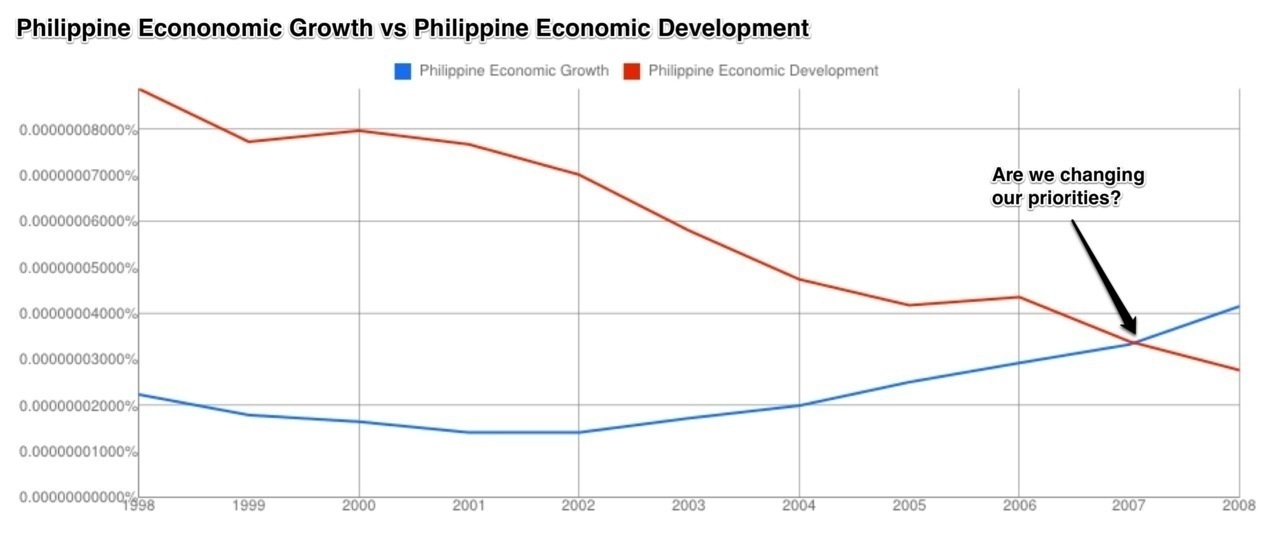

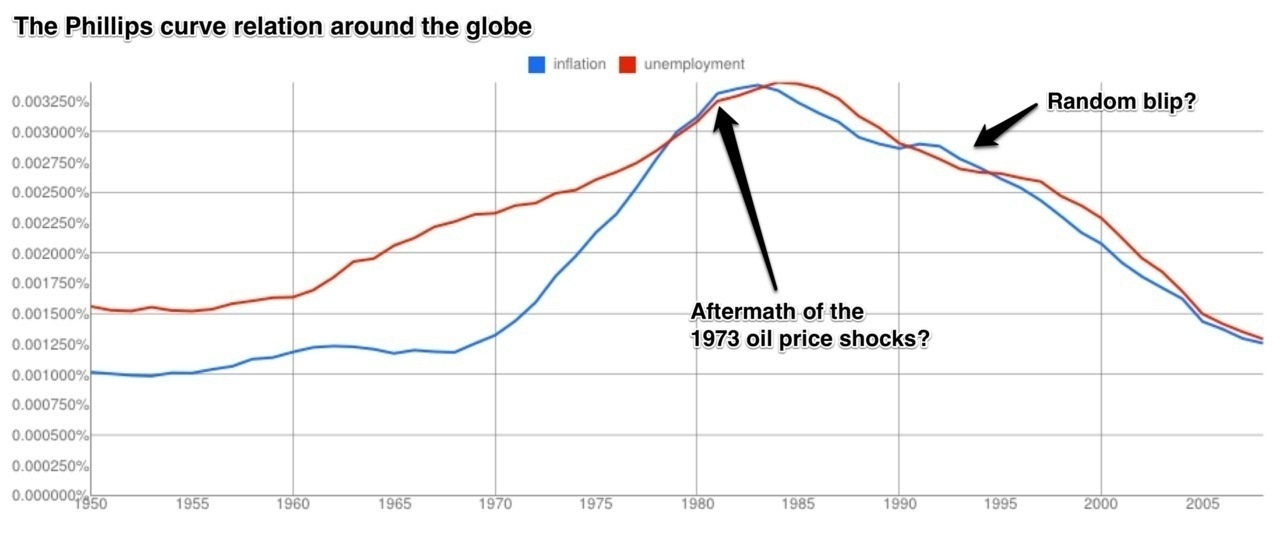

This installment reveals that growth is now more important than development, the Phillips curve’s tradeoffs do not necessarily apply to this measure, that fiscal policy is largely affected by current economic conditions, and much more. See the graphs below (click to enlarge):

aliases: - 2012/05/on-ngrams-part-2-philippine-economy.html - content/thoughts/2012-05-22-on-ngrams-part-2-philippine-economy/on-ngrams-part-2-philippine-economy.html - posts/2012-05-22-on-ngrams-part-2-philippine-economy - thoughts/on-ngrams-part-2-philippine-economy

On Ngrams - Philippine History Quantified in Books

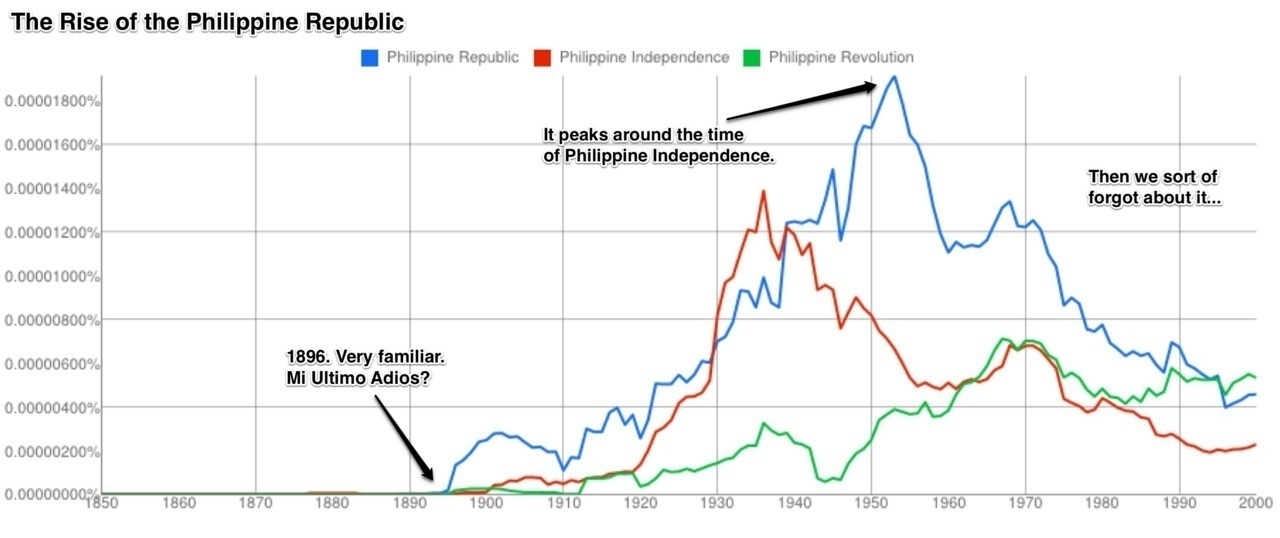

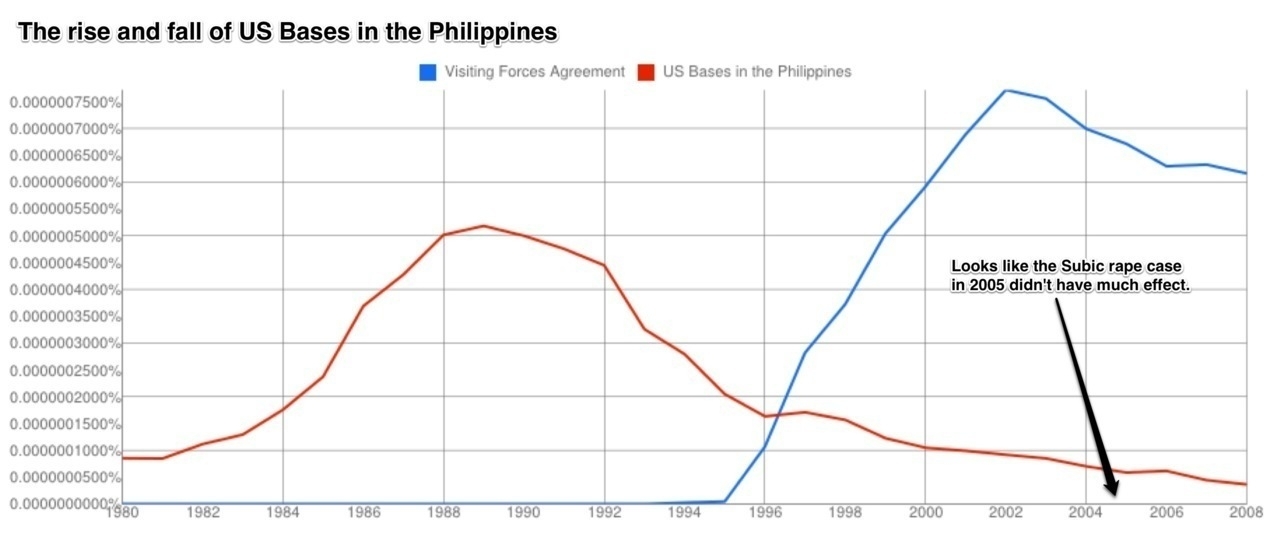

I’ve been messing around with the Google Ngram Viewer which was highlighted in a previous video post. If you don’t already know, ngrams are basically charts that display how often a word or phrase appears in Google’s entire book collection. It’s a rough but quick and easy way to find out what people were writing about in various time periods.

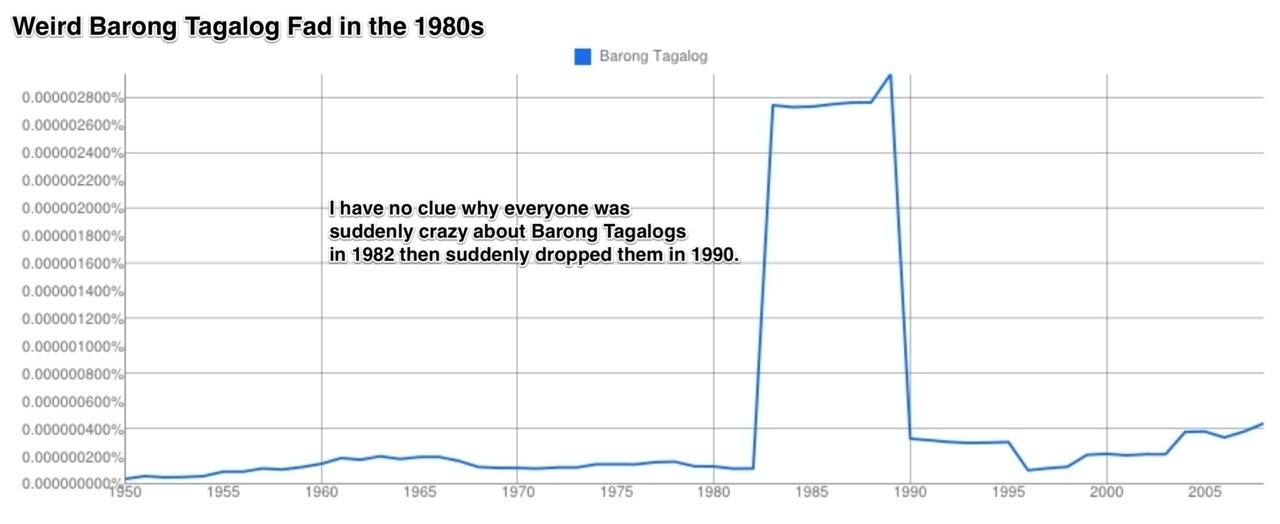

I’ve been digging around for interesting results on Philippine history and this is what I found. These range from revealing censorship in the Marcos period, proving that Rizal really was the spark of the Philippine revolution, to a weird time in the 1980s when people were crazy about the Barong Tagalog.

I have another set coming up soon on the Philippine economy, so watch out for that if this interests you. :D

aliases: - 2012/05/on-ngrams-philippine-history-quantified.html - content/thoughts/2012-05-14-on-ngrams-philippine-history-quantified/on-ngrams-philippine-history-quantified.html - posts/2012-05-14-on-ngrams-philippine-history-quantified - thoughts/on-ngrams-philippine-history-quantified

On Prize-Linked Savings

The Philippines GDP is still mainly spent on end consumption, crippling to a country that needs to develop and upgrade its own industry.

I love quirky solutions to economic problems, and this is no exception. Consider these two issues:

This Freakonomics podcast showcases a new financial product that could be the stone to kill both birds: prize-linked savings. Essentially, it’s a savings account with a twist. You get an interest rate that is a bit lower than the prevailing rate, but all these small amounts of interest are pooled together to create a lottery fund which will be given out to some lucky depositors every month or so.

On that Moment of Choice

No matter how rationally we try to act, that one moment of choice is still a purely emotional exercise.

I was reading this great book, and I found out something which may be useful for economists: that moment when you make a decision among close alternatives, is purely emotional. This is what the book has to say:

It’s purely emotional, the moment you pick. People with brain damage to their emotional centers who have been rendered into Spock-like beings of pure logic find it impossible to decide things as simple as which brand of cereal to buy. They stand transfixed in the aisle, contemplating every element of their potential decision—the calories, the shapes, the net weight—everything. They can’t pick because they have no emotional connection to anything

This is why companies are now starting to limit the variety in their product lines (the consummate example being Apple, of course), because it makes it easier to make an emotional connection and create post-hoc rationalizations about your choice. It may seem a little manipulative but this decision-making heuristic makes our lives easier; one just has to realize their cognitive biases.

It’s quite in line with the bounded rationality of behavioral economics; that people make choices rationally but only up to the extent of what they know and how they think. If this interests you, Predictibly Irrational and other books by Ariely are great reads.

aliases: - 2012/05/on-that-moment-of-choice.html - content/thoughts/2012-05-02-on-that-moment-of-choice/on-that-moment-of-choice.html - posts/2012-05-02-on-that-moment-of-choice

On Stochasticity

Sometimes the noise is more important than the signal.

The ui represents stochasticity in this linear regression.

We all know that letter at the end of the sample regression function: u. It’s the stochastic disturbance term. Peculiarly, it is absent in the population regression function, the form and intensity of which is, according to my professor, only known to God. If you follow this vein of thought, you would eventually come to the conclusion that the u is simply the sum total of our ignorance. I disagree; I believe that the u represents something more than the lack of knowledge; it represents change and freedom. That u actually captures all effects, big or small, that weren’t and cannot be captured in the structured hash of the equation; the chaos in the world, as one might say.

Read More →