Economics

On the Effectiveness of Higher Sin Taxes (2014 Q2 Update): Losing Steam?

We update our assessment on the effectiveness of sin taxes with fresh national accounts data for the second quarter of 2014, and learn that sin taxes may be losing steam - smokers and drinkers may be having a hard time kicking the habit.

How are higher sin taxes faring a year and a half after their implementation? (Photo: Fried Dough/Flickr, CC BY 2.0, cropped)

When we first covered the new sin taxes in 2013, we focused on its effect on household consumption of alcohol and cigarettes, and subsequently updated it to reflect the 2013Q3 stats. Now that sin taxes have been in effect for roughly a year and a half and has even kicked it up a notch, let’s review national accounts data from the Philippine Statistics Authority (then NSCB), to see how it has fared.

On Pump Prices: Where can you gas up for less?

BLACK GOLD - In a time of risi’ng oil prices, it might pay off to be a little more data-savvy about where you gas up. (Photo: Patricia Feaster/Flickr, CC BY 2.0)

What providers let your stretch you gas money for more miles? Where is it more economical to gas up? Data from the Department of Energy’s price watch can provide some data-driven answers to these questions.

Everyone has something to say about gas prices - it’s cheaper to gas up with this provider than another, or it’s more economical to fill the tank in this area than another. With data from the Department of Energy’s price watch, we can provide data-driven answers to these questions, so that you can stretch out your gas money for just a few more kilometers.

On the Economics and Data of Love, Dating, and Relationships

Last Valentine’s Day, I was asked by my former college organization to deliver a talk on the “data of love, dating, and relationships” as part of their Young Economists' Lecture and Learning Series at De La Salle University.

I thought I’d share the presentation with you and put this up for posterity’s sake. Hopefully, you can piece together what I was talking about.

I’d appreciate it if you liked, tweeted, shared, or +1’ed this post on your preferred social network, as well as shared your thoughts in the comments section.

On the S&P Credit Rating Upgrade: The Numbers Behind BBB

Ratings agency Standard & Poor’s (S&P) has raised the Philippines sovereign credit rating from BBB- to BBB, making it fully in the ranks of investment-grade sovereign debt. Let’s look through those three B’s and look at the data behind their decision.

CREDIT UPGRADE - Credit rating’s, despite focusing on government-issued debt, include a variety of factors, such as political and economic risks, and are thus used to gauge the overall creditworthiness and economic outlook of a country’s economy. In this photos is Makati City, the central business district of the country. (Photo: chattygd/Flickr, CC BY 2.0)

The Philippines has received yet another credit rating upgrade, from BBB- to BBB, nudging it further into investment-grade territory. What do these letters really mean, though? We can take a look at the data that S&P has provided in support of their decision in this main and supplementary article, to find out more.

Before we look at the data, let’s define sovereign credit ratings. These ratings are regularly provided by ratings agencies (that largest of which are S&P, Fitch, and Moody’s) on sovereign debt or government issued debt, as a measure of the ability of a certain government to repay debt. Because governments ability to pay is dependent on various risks - political risks can cause policy changes, economic risks can cause changes in tax revenue - these ratings are also used to assess the general economic environment in a country.

The numbers that we will look at are all based on S&P reports. Take note that the figures for 2013 are expected figures, and those for 2014 onwards are forecasts developed by S&P.

Economic and Financial Indicators: Full Steam Ahead!

The first category of indicators that S&P uses in its assessment are economic and financial indicators that relate primarily to the internal economy and how it is able to generate and continue generating income and tax revenues.

GDP growth (upper-left) has been at a very impressive 4%-7% after the impact of the US financial crisis faded in 2009, and is expected to stay within 6% up to 2016. GDP per capita growth, which discounts the effect of population growth, is steady, implying that economic growth will continue to keep pace with the population. The same is true for number of employees. The fact that GDP per capita growth is expected to be higher than GDP per employee growth is because of the expanding labor force or demographic transition.

Investment and external demand (exports) (lower-left) have been the key drivers of growth for the Philippines, especially in 2010 when investors fled from the troubled US and Europe markets and into emerging markets. Domestic demand has little impact on economic growth.

Good news! Unemployment and inflation (upper-right) have both been on a downward trend - a very rare and exciting economic phenomenon. This suggests an increase in real wages, so that more people can feel the impact of increased economic growth.

Savings rates (lower-right) are not that impressive, hovering at around 25% and expected to fall further up to 2016. This is mitigated by the fact that more of these loanable funds will be used in productive investment, keeping the level of investment constant in relation to output.

S&P cites the public-private partnership program as one of the factors for boosting infrastructure projects, but identifies low GDP per capita levels and slow employment growth as key rating constraints.

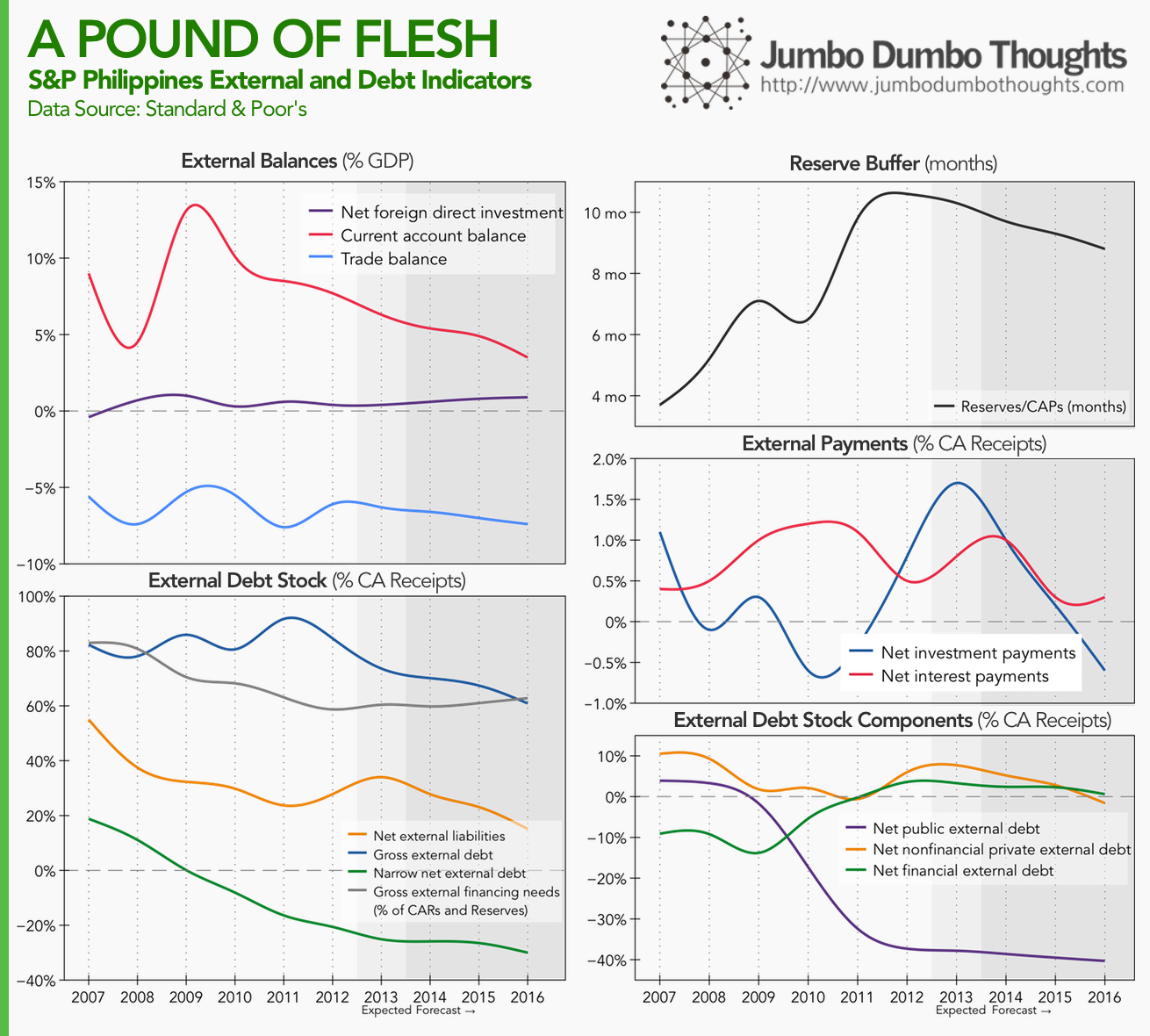

External and Debt Indicators: Paying down the debt

The second category of indicators concerns the economy’s interaction with the world at large - foreign investment, foreign debt, and capital flows between the Philippines and the rest of the world.

The Philippines' economic performance has caused an improvement in its debt standing. In terms of external balances, current account (upper-left) has stayed at a surplus, meaning that the country is a net lender to the rest of the world. This is because of large OFW remittances, evidenced by the large variance between foreign investment and the current account surplus. The current account surplus is expected to diminish in the future.

In terms of external debt stock (lower-left), all broad and narrow measures of debt are falling. Furthermore, narrow net external debt at a negative level means that we are less vulnerable to shocks if investors decide to pull their funds out of the country since it’s now a net external lender. However, gross external financing needs are still high at 60% to 80%, probably because of reliance on OFW remittances, and more recently the BPO sector. S&P doesn’t expect these inflows to stop anytime soon, however.

The reserve buffer (upper-right) is high; the country can last 9 to 10 months if funds continuously flow out of the country, without any receipts. In 2015, we can expect to be a foreign investor country ourselves, with net investment payments (middle-right) below zero. Net interest payments are also expected to fall.

If we look at who is contributing to the decrease in the country’s debt (lower-right), it’s amazingly the government (public external debt) that’s getting its foreign debt standing together and thus releasing loanable funds for investment in the private sector.

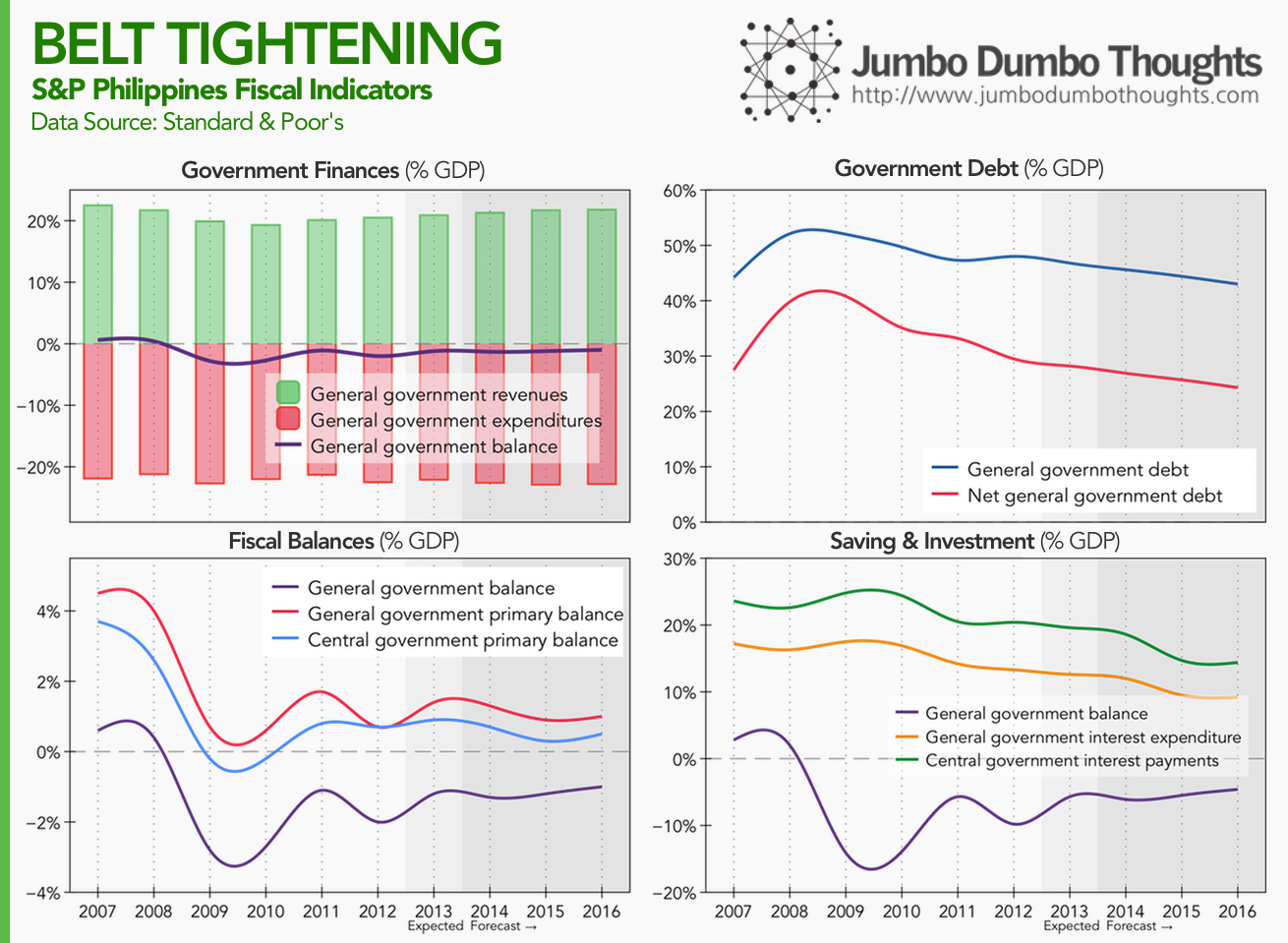

Fiscal Indicators: Prudent Government

The third category of indicators exhibited by S&P relates to fiscal standing, or how well the government is handling its finances (from a strictly inflow-outflow perspective, where those funds come from, and go, is a different question entirely).

Government has been able to stay at a slight deficit (upper-left), managing its revenues and expenditures quite well. Furthermore, if we remove the impact of interest payments on preexisting government debt (the resulting measure is known as the government primary balance), the figures (lower-left) for both general government (which includes LGUs and GOCCs) and central government are on the positive, meaning that government can support its operations with current receipts and continue paying down debt and subsequently incurring lower interest expense, which is seen in the upper-right panel and the lower-right panel, respectively. However, S&P cites lack of infrastructure and efficient government programs as constraints.

Other Considerations

S&P also assesses monetary policy by the central bank, cites low domestic debt levels, well-anchored and credible monetary policy, and low inflation, as risk-reducing factors, but also notes that high-risk lending to a potentially overheating property sector and underdeveloped capital markets that limit monetary policy transmission as risks.

That’s the data behind the BBB rating. Hopefully, you can now see where specifically the Philippines has improved, has faltered, and has jogged in place. Hope you enjoyed reading!

Thanks for reading! If you found this post interesting, I’d really appreciate a share on your social networks or a comment with your thoughts. Data is taken from the S&P supplementary article.

aliases: - 2014/06/on-sp-credit-rating-upgrade.html - content/blog/2014-06-01-on-sp-credit-rating-upgrade/on-sp-credit-rating-upgrade.html - posts/2014-06-01-on-sp-credit-rating-upgrade - articles/on-sp-credit-rating-upgrade

On Purchasing Power Parities, the Big Mac Index, and the International Comparison Programme

The GDP per capita of the Philippines exceeds that of India by 55%, but the cost of living is so much cheaper in India that if you account for cheaper goods and services, that difference narrows to only 20%. In this first installment of Numbersense, we will take a look at purchasing power parities and why they are important for cross-country comparisons.

It’s easy to compare commonly-available figures such as GDP per capita to gauge a country’s wealth, but differences in cost of living means such comparisons leave much to be desired. (Photo: Nina Matthews/Flickr, CC BY 2.0)

This is the first in a series of posts about ‘numbersense,’ or making sure that data analysis and visualization is in consonance with what the underlying data represents.

On the Filipino Migration and Remittances: The grass is still greener on the other side

The Filipino diaspora has been a relatively well-documented phenomenon, as poor circumstances in the domestic economy nudge others to seek greener pastures abroad. But where exactly do these people go, and how have the trends changed since 1990? Also, are there any people coming in to the country? Let’s take a look at the data.

LEAVING ON A JET PLANE. Where do these Filipino migrants go, and which nationalities migrate into the Philippines? In this photo, a migrant worker from Bangladesh, a country which faces similar economic circumstances as the Philippines, awaits his flight. (Photo: Faisal Akram/Flickr, CC BY-SA 2.0)

Economic circumstances and an oversupply of labor in the domestic market have caused what some people have called the Filipino diaspora - a large outflow of migrant workers and overseas contract workers seeking better jobs - and pay - abroad.